Business owners and leaders of startups, churches, religious organizations, schools, and non-profits that started a new business during the COVID shutdown can receive up to $100,000 in new funding. IRS is legally bound to issue payroll tax refunds to qualifying companies defined as a Recovery Startup Business (RSB).

This one-of-a-kind program represents a golden opportunity to secure funding for the right business, church, school, or non-profit.

Many new service providers have offered to help businesses file for their refunds. These days, finding a real ERC tax credit refund specialist with in-depth knowledge of the necessary qualifications and filing procedures can take a lot of work. Without the proper guidance, businesses that try to do it themselves or, even worse, go with a fly-by-night provider can result in less of a refund and possible IRS audits down the road. Ensuring an ERC Tax Refund filing services provider can verify a business’s qualifications and knows how to file correctly is vital to success and getting all an RSB is entitled to.

Since February 2020, Corporate Strategies Merchant Bankers has assisted businesses, churches, schools, and non-profits in receiving CARES Act emergency funding through PPP loans, EIDL loans, ERC payroll tax refunds, and Recovery Startup Business funding.

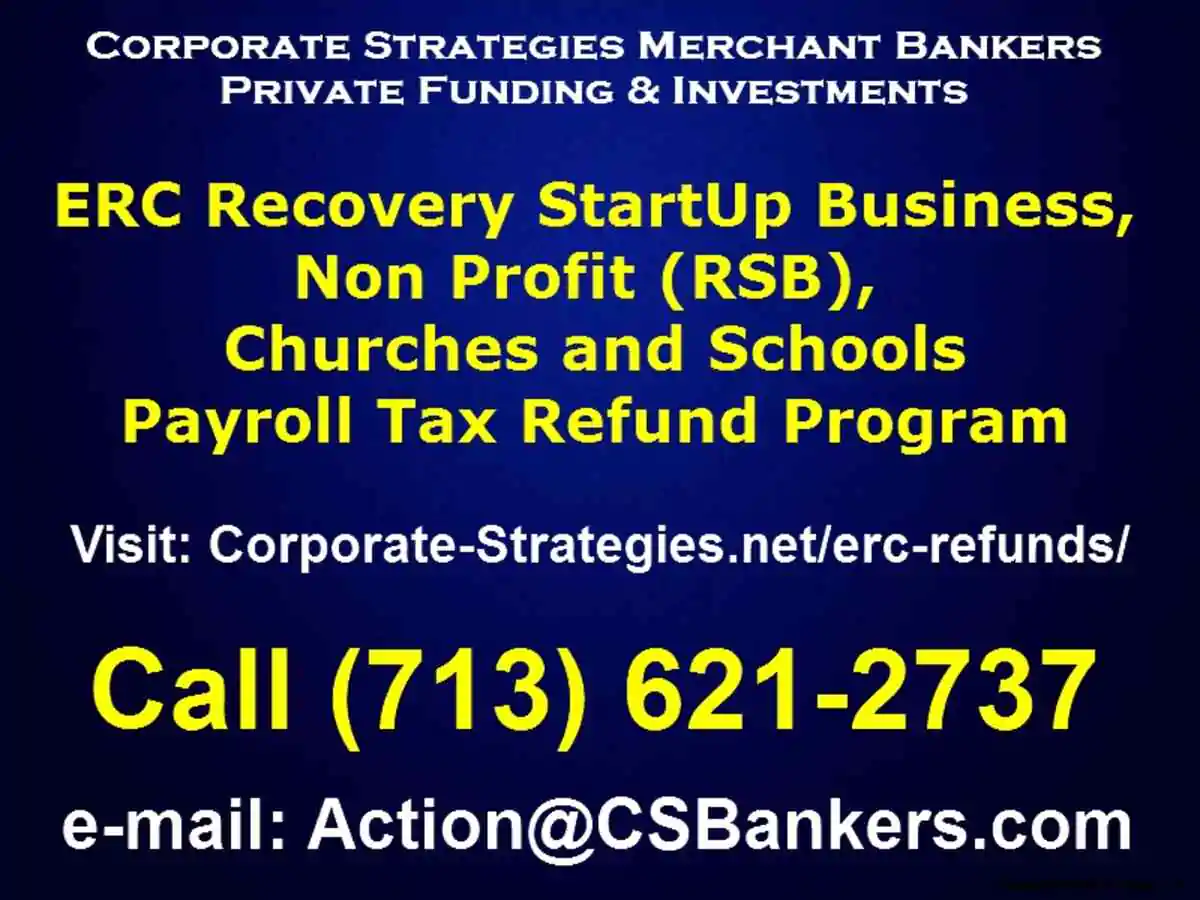

For more information on the ERC Tax Refund Program:

Call (713) 621-2737

email Action@CSBankers.com or

visit https://corporate-strategies.net/erc-refunds/

Corporate Strategies understands the unique elements of qualification for the ERC Tax Refund by businesses, religious organizations, schools, and non-profits. The company was fully involved with the CARES Act legislation before it passed. Their principal owner has in-depth knowledge of the Senate distribution list for the CARES Act and its several revisions. This first-mover knowledge of the CARES Act provisions enabled their clients to quickly obtain PPP, PPP2 loans, EIDL loans, and Employee Retention Tax Credit Millions of dollars in refunds were issued before most service providers even grasped the rules for receiving them.

Corporate Strategies has created a one-of-a-kind body of knowledge. to accurately qualify diverse types of organizations for the maximum legal tax refund. This experience analyzing the provisions of the CARES Act and the hundreds of pages of IRS documents on how to qualify and composition ERC Tax Refunds has resulted in tax refunds ranging from $70,000 to $2,900,000. Much of this funding was for parties previously informed by tax professionals that they did not qualify for the ERC Tax Refund program.

Corporate Strategies is a private lending and real estate investment community leader. The company achieved this by successfully financing small to medium-sized businesses and startups (SMBs) that conventional banks have rejected. They actively invest in commercial real estate acquisitions, development, private lending for bank non-renewal of business loans, and personal lender asset-based financing.

Tim Connolly is CEO and founded Corporate Strategies Merchant Bankers in 1989. Tim and the Corporate Strategies team have extensive public and private company experience in the US and International Merchant Banking, creating unique non-bank funding solutions for SMBs and leading turnaround operations teams in the USA, Canada, and the European Union.

Corporate Strategies (https://CSBankers.com) is a leader in the private lending and real estate investment community. The company achieved this by successfully financing small to medium-sized businesses and startups (SMBs) that conventional banks have rejected.

They actively invest in commercial real estate acquisitions, development, private lending for bank non-renewal of business loans, and personal lender asset-based financing.

Since February 2020, Corporate Strategies has also assisted businesses, churches, and non-profits in receiving CARES Act emergency funding through PPP loans, EIDL loans, ERC payroll tax refunds, and Recovery Startup Business funding.

Tim has been a nationally syndicated radio commentator and guest on CNBC, ABC, NBC, and other business and political news programs. He holds Business, Marketing, and Business Administration undergraduate and Masters degrees from Texas A&M University, College Station, and Canyon, Texas.

Read Also: Optimize Your Banking with United Finance

What is Showbox? Showbox is a widely recognized streaming program that offers free access to…

Hey there! Have you ever wondered how YouTube, the video-sharing giant, influences what games and…

Hey there! So, you've seen the Bob's Bookkeepers and occur to be curious to know…

Hey there! Ready to dive into the world of personalized perfumes and custom fragrances? Whether…

Hello, fellow online novice! If you've ever found yourself watching your computer screen, feeling a…

If you've been recognized as a convenient and successful way to enjoy your facilities, you've…